Upgrade & Secure Your Future with DevOps, SRE, DevSecOps, MLOps!

We spend hours on Instagram and YouTube and waste money on coffee and fast food, but won’t spend 30 minutes a day learning skills to boost our careers.

Master in DevOps, SRE, DevSecOps & MLOps!

Learn from Guru Rajesh Kumar and double your salary in just one year.

Source:-themarketstrategies.com

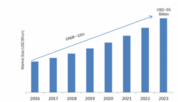

The global continuous delivery market is forecast to reach USD 6.48 Billion by 2026, according to a new report by Reports and Data. The rising trend towards digitalization and the adoption of DevOps will drive the growth of the market. Moreover, the emergence of automation in application deployment will also have a positive impact on the growth of the market.

Continuous delivery provides the developers with a proper feedback loop, which resolves the issues faster. Tools and processes involved keep track of the changes done in the project without being lost. Similarly, tools for automating the provisioning of environment helps in saving time and efforts. It also ensures compliance and security practices from the beginning of the development lifecycle. This benefits the developers in many ways, including better end-to-end visibility to trace the changes & error codes; writing new & quality codes; and faster feedback loops, among others.

Further key findings from the report suggest

- Generally, the pipeline run is triggered by a source code repository. A variation in code triggers a notification to the CD tool, which runs the corresponding pipeline. Also, failure to pass the next stage, which is the build stage indicates a fundamental problem in the configuration of the project.

- The large-sized organizations account for a larger market share of ~64% in the year 2018, owing to the increasing investments by these firms on continuous delivery and DevOps.

- The on-premises deployment type accounts for a larger market share of ~59% in the year 2018. On-premises deployment of these software and services ensures the security of the confidential data of the firms. Moreover, information deployed on-premises provide better accessibility and security to the organizations.

- The solution component accounts for a larger market share of ~55% in the year 2018. The solution segment is further segregated into software and hardware solution. The increasing demand for painless software deployments, with lower risk events that can be performed at any time, will be the major factor contributing to the growth of the solutions segment.

- The IT & telecommunication industry account for the largest market share of ~21% in the year 2018, attributed to the emergence of advanced technologies like artificial intelligence, IoT, and machine learning. The IT and telecom sector has digitized and offers a unique customer experience to match the shifting customer behaviors. Their investment in end-to-end digital operations has driven the growth of the industry.

- North America held the largest market share of ~30% in the year 2018, owing to the presence of some of the leading players of the market in the region. Moreover, the region is one of the technologically advanced regions. With the rising application of big data analytics using artificial intelligence and machine learning, the need for seamless delivery of applications has become critical for the players in the region.

- Key participants include IBM, Atlassian, CA Technologies, Xebialabs, Puppet Enterprise, Electric Cloud, Cloudbees, Chef Software, Flexagon, Microsoft, Clarive, Micro Focus, Wipro, Accenture, Applariat, VMware, Shippable, Red Hat, Spirent, Circleci, Jetbrains, Heroku, Appveyor, Bitrise, Kainos, and Infostretch, among others. The companies have adopted various strategies, including mergers, acquisitions, and partnerships to hold ongoing trails and come up with new developments in the market.

For the purpose of this report, Reports and Data have segmented into the global continuous delivery market on the basis of pipeline stages, deployment type, organization size, component, industry vertical, and region:

Pipeline stages Outlook (Revenue, USD Billion; 2016-2026)

- Source stage

- Build stage

- Test stage

- Deploy stage

Organization Size Outlook (Revenue, USD Billion; 2016-2026)

- Small and Medium-Sized Enterprises

- Large Enterprises

Deployment type Outlook (Revenue, USD Billion; 2016-2026)

- Cloud

- On-premises

Component Outlook (Revenue, USD Billion; 2016-2026)

- Solution

- Software

- Hardware

- Services

- Professional Services

- Managed Services

Industry Vertical Outlook (Revenue, USD Billion; 2016-2026)

- Banking, Financial Services, and Insurance (BFSI)

- Retail and Consumer Goods

- Healthcare

- Manufacturing

- Telecom and IT

- Education

- Media and Entertainment

- Others

Regional Outlook (Revenue, USD Billion; 2016-2026)

- North America

- U.S.

- Europe

- UK

- France

- Asia Pacific

- China

- India

- Japan

- MEA

- Latin America

- Brazil

Starting: 1st of Every Month

Starting: 1st of Every Month  +91 8409492687 |

+91 8409492687 |  Contact@DevOpsSchool.com

Contact@DevOpsSchool.com