Upgrade & Secure Your Future with DevOps, SRE, DevSecOps, MLOps!

We spend hours on Instagram and YouTube and waste money on coffee and fast food, but won’t spend 30 minutes a day learning skills to boost our careers.

Master in DevOps, SRE, DevSecOps & MLOps!

Learn from Guru Rajesh Kumar and double your salary in just one year.

Source:-bfsi.eletsonline.com

Industry reports around the world believe that Cloud technology is a critical enabler of the Industrial Revolution 4.0. As the new Industry Revolution starts the ignition, cloud computing is effectively supporting the developments on the Internet of Things (IoT), automation and robotics. On the basis of experts’ opinion and latest researches, Rashi Aditi Ghosh of Elets News Network (ENN) explores how embracing the cloud can help the processes in banking and financial industry operate more efficiently and rise above the competition.

Unfolding Industrial Revolution 4.0

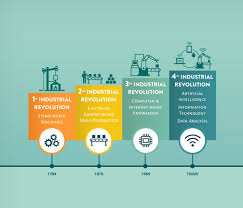

The original Industrial Revolution that occurred around the eighteenth century completely changed the world we live by connecting the energy of water and steam to power machines that helped the workers in producing goods much more swiftly.

The second Industrial Revolution began with the rise of mass production lines. By the time information technology could begin to automate production in the twentieth century, the third Industrial Revolution had come into motion.

Now, the fourth Industrial Revolution has arrived, all thanks to the massive developments pertaining to the Internet of Things (IoT), automation and Artificial Intelligence. These technologies, along with big data and analytics, comprise the key elements behind the onset of the new industrial revolution, popularly known as Industry 4.0.

The new revolution is driving massive developments across several sectors and the Banking, Financial Services and Insurance (BFSI), in particular, witnessed several major changes.

In the financial services sector, automation is used to deal with an ever- increasing volume of data, whether for customer service or shifting focus to areas such as security and risk.

Role of Cloud Computing in Boosting Industrial Revolution 4.0

No matter which segment of the industry you are associated with, cloud technology is playing the part of a critical enabler boosting the next Industrial Revolution, by offering the means for businesses to innovate around these technologies.

According to an Oracle report titled Cloud: opening up the road to Industry 4.0, out of the 1,200 technology decision- makers surveyed across EMEA in midsize and large companies, 60 percent talked in favour of an integrated cloud approach and said that it will unlock the potential of disruptive technologies, such as robotics and artificial intelligence.

Experts believe that no matter what industry you’re in, cloud technology is definitely a critical enabler of the next Industrial Revolution, by offering the means for businesses to innovate.

The true potential of cloud in support of the fourth Industrial Revolution can only be determined via the integration of compute services with a cloud platform. By tapping into the strength of compute services, cloud platforms support innovative and disruptive applications.

Why Cloud Computing in Significant for Indian BFSI Sector?

Whether we agree or we don’t, there is a big shift to the cloud which is happening.

Research from the Harvard Business Review Analytic Services reveals that 74 percent of businesses believe cloud computing has given them a competitive advantage. Further research reveals that 60 percent of technology decision-makers believe an integrated cloud approach will unlock the potential of disruptive technologies.

“According to IDC, by 2022, though traditional softwares, will also grow but it will grow just at a rate of 11 percent. Whereas cloud infrastructure and cloud-based applications will grow at a whopping percentage of 150 plus, but it will have its own challenges,” says Gulshan Chhabra, Country Manager, Snow Software Further, India is most likely to lead the world in hybrid cloud usage and adoption in the coming years, according to a study by enterprise cloud computing firm, Nutanix. The adoption of hybrid cloud workloads in India will be more than triple from 13 percent in 2018 to 43 percent in the coming 24 months.

Diwakar Nigam, Managing Director, Newgen Software believes that the banking sector has always been at the forefront of cloud adoption. And the reason behind this adoption is the advantages like scalability, lower capital costs, ease of operations and resilience.

“Cloud computing has undoubtedly added new dimensions to the way businesses go about their daily chores. Organisations need to harness the power of a low-code platform through a flexible and scalable and agile model. Cloud deployment has addressed these requirements by creating new avenues for cost-effective software delivery and development. Our cloud-ready products are available on private and public clouds and extend support for hybrid models. The Cloud/SaaS business continues to be Newgen’s fastest-growing revenue component at a 5 year CAGR of 127 percent,” says Nigam.

According to an industry report, businesses around the world are taking optimum advantage of the benefits that cloud technology brings to them. As a matter of fact, the global market for cloud computing is expected to grow from $272 billion in 2018 to $623 billion by 2023.

NASSCOM reports that the cloud market in India is also expanding quickly and expected to grow to $7.1 billion by 2022. The financial services industry, is rapidly adopting cloud technology. The disruptive wave of digital transformation that is transforming the financial services segment and it is drawing a lot of its power from the cloud.

Research from the Harvard Business Review Analytic Services reveals that 74 percent of businesses believe cloud computing has given them a competitive advantage. Further research reveals that 60 percent of technology decision-makers believe an integrated cloud approach will unlock the potential of disruptive technologies.

Talking about the relevance of cloud computing in terms of the Banking, Financial Services and Insurance (BFSI) sector, T V Ramanmurthy, General Manager – IT, Bank of Maharashtra, said, “Before implementation of cloud computing in the BFSI sector, it is important to accept the relevance of the technology first. In 2017, when BHIM and Unified Payments Interface were implemented National Payments Corporation of India (NPCI) took six months to realise the vitality of cloud technology in the implementation of the above-mentioned interfaces.

Explaining about the implementation of cloud services further, Zulkernain Kanjariwala Head – IT, Doha Bank said, “Each and every financial institution in India has its own perception pertaining to leveraging cloud technology in their institution completely. In reference to the current level of digitisation in the country, it is evident to make use of tech-driven initiatives and cloud is definitely going to play a major role in the transformation.”

Benefits of Cloud Computing in Banking and Finance Sector:

While cloud computing and its rising significance has touched all the major industries around the world, financial institution, in particular, have great benefits associated with this technology. Ranging from cost-effectiveness, reliability, flexibility and many more, cloud computing offers an answer to all the major queries of the banking and financial institutions.

Cost-effective:

Cloud computing helps the bankers and financial institution in saving their capital expenditure engaged in establishing IT infrastructure for meeting several IT needs. A major chunk of capital expenditure is transformed into comparatively nominal operating expenses with the application of cloud. This allows banks and financial institutions to emphasise on core banking functions.

Reliability:

The cloud infrastructure scores high in terms of reliability. By choosing private or hybrid cloud model, it becomes possible for the banks to secure their data while exploring the speed and flexibility of the cloud. In the case of public clouds also the data gets encrypted and several other layers of security like permission-based access can be added to further boost the level of security.

Flexibility:

The most important reason behind accounting for the reputation of cloud is its pay-as-you-use model of billing. This signifies that the user is only required to pay for the services used. Banks and other financial service providers can conveniently manage the rise in demand without making extra investment in expensive in-house computing source, much of which would go unutilised under non-critical conditions. In case of cloud, it becomes easier to pivot from one application to another making it a flexible choice.

Leading Applications of Cloud in BFSI:

Cloud computing is there in the picture since the 1960s. However, the pivotal innovations started only post the launch of Amazon Web Services (AWS) in 2002. Now there are several other web applications that are delivered via cloud computing. Some applications of cloud computing in banking and finance segment are as follows:

Hosting:

In a bid to ensure secure transactions and efficient customer experience, banks require cent percent uptime. In-house IT systems entail periodic maintenance after which it becomes hard to offer continued service. In these circumstances, Cloud, can provide 99.999 percent uptime by offering server availability even at the time of maintenance. Hosting of mobile and web apps also ensures better speed to the users.

According to IDC, by 2022, though traditional softwares, will grow but just at a rate of 11 percent. Whereas cloud infrastructure and cloud-based applications will grow at a whopping percentage of 150 plus, but it will have its own challenges.

Payment Gateway:

Major lenders have already deployed cloud computing for initiating payments and funds transfer. Cloud offers security and unified customer experience. It is also important to note that the uptime offered by cloud also ensures that payments are processed securely from without any discrepancies.

ERPs and CRMs:

Enterprise Resource Planning (ERP) and Customer Relationship (CRM) software are the most go to (popular) applications provided by the cloud. Accounting for 50 percent of total usage, Software as a Service (SaaS) is one of the most in demand methods used for leveraging cloud computing. It helps the vendor in controlling the application and provides better support. For users, it permits remote access and easy installation.

Conclusion

While most of the experts opine that the cloud computing can transformation across the banking and financial sector and offer support to the industrial revolution 4.0, however, it is significant to implement this technology keeping security, Regulatory and compliance and business alignment in mind. Experts across the sector also believe that the cloud-based services should be deployed only through leading and trusted cloud services providers should be chosen.

The advantages of today’s cloud technology can go beyond reliability, scalability and storage (and the associated cost savings) within Industry 4.0.

Starting: 1st of Every Month

Starting: 1st of Every Month  +91 8409492687 |

+91 8409492687 |  Contact@DevOpsSchool.com

Contact@DevOpsSchool.com