Upgrade & Secure Your Future with DevOps, SRE, DevSecOps, MLOps!

We spend hours on Instagram and YouTube and waste money on coffee and fast food, but won’t spend 30 minutes a day learning skills to boost our careers.

Master in DevOps, SRE, DevSecOps & MLOps!

Learn from Guru Rajesh Kumar and double your salary in just one year.

Source:- 1reddrop.com

If you are running a business, there is a near 100% chance that you are already using some form of SaaS – Software as a Service. According to a recent a survey by Northbridge and Wikibon, one in seven companies are using SaaS. But that number should be much higher if you include Email, YouTube and social media applications such as facebook, Twitter, LinkedIn and so on.

These are applications that have already embedded themselves into our lives. Many of them are free so we don’t think of them as SaaS products but, in reality, they are monetized by the company through advertisements. Though we get them for free, in roundabout way, we, the users, are paying for these applications with the time we collectively spend on them.

But SaaS is doing a lot more than permeating into our lives. It is also gradually pushing the traditional software licensing model into the background. The days of software installations are slowly, but surely, coming to an end. Today, we are increasingly embracing the “on-demand and pay-as-you-go” model of software deployment.

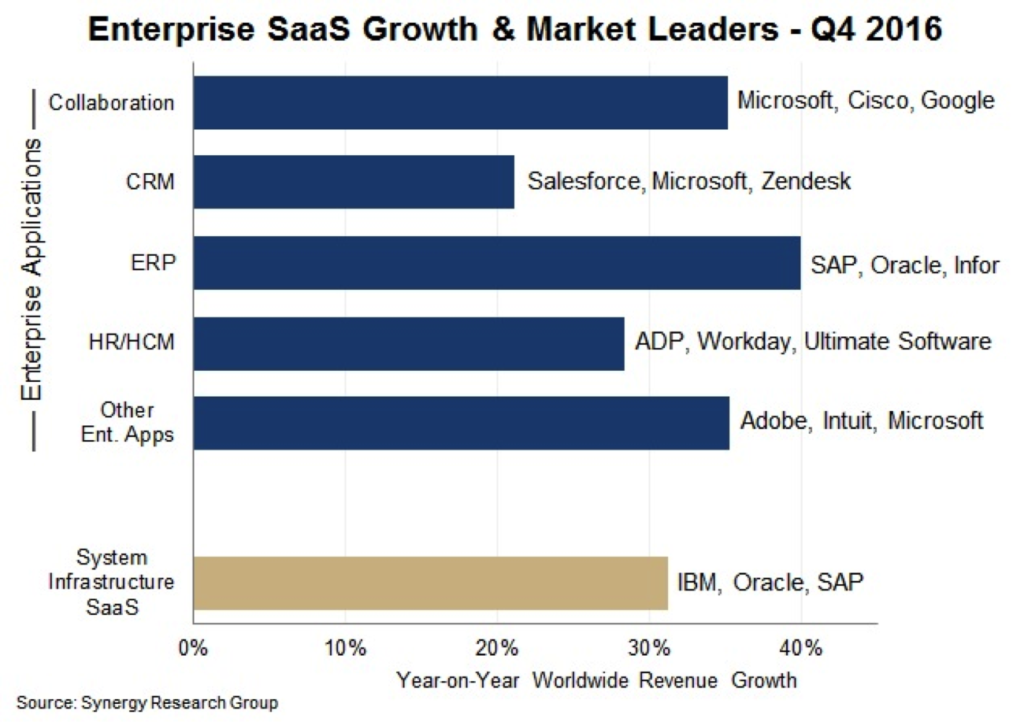

The SaaS market has been growing steadily over the years, and things are only going to accelerate in the future as more companies start opting for the cloud-delivered model of selling software. According to Q4 data from Synergy Research Group, the enterprise SaaS market grew 32% to reach $13 billion in revenues.

The research group also says that Microsoft has taken the pole position from Salesforce to become the Number One enterprise SaaS player in the world. Microsoft’s SaaS is primarily focused on collaboration software, while Salesforce concentrates on Customer Relationship Management, or CRM, software, says Synergy.

“For the third successive quarter Microsoft is the clear leader in overall enterprise SaaS, having overtaken long-time market leader Salesforce. Other leading SaaS providers include SAP, Oracle, Adobe, ADP, IBM, Workday, Intuit, Cisco and Google. Among the major SaaS vendors those with the highest growth rates were Oracle and Google, the latter thanks to a big push for its G Suite collaborative apps.” – Synergy Research Group

Microsoft does not break out revenue numbers for each of its SaaS products, but rather puts them all in one place – under the Productivity and Business Processes segment. During the most recent quarter this segment reported $7.4 billion in revenues, posting a growth of 10% compared to the prior period.

This segment contains Office commercial products, which are volume-licensed to customers, Office 365, the SaaS version of Office, and Dynamics 365, Microsoft’s enterprise management SaaS.

As Office 365 grows, it will not only take away potential customers of Office commercial, but it will also be cannibalizing its existing user base. But, despite this, the segment has grew by ten percent, and that says a lot for Office 365’s ability to admirably offset any decline in legacy licensing revenues.

Meanwhile, Salesforce has also been growing at double-digit rates for the past several years. They took the initiative in the CRM market by offering products in the as-a-service model, while big enterprises like Oracle and SAP stuck to the old way of selling software.

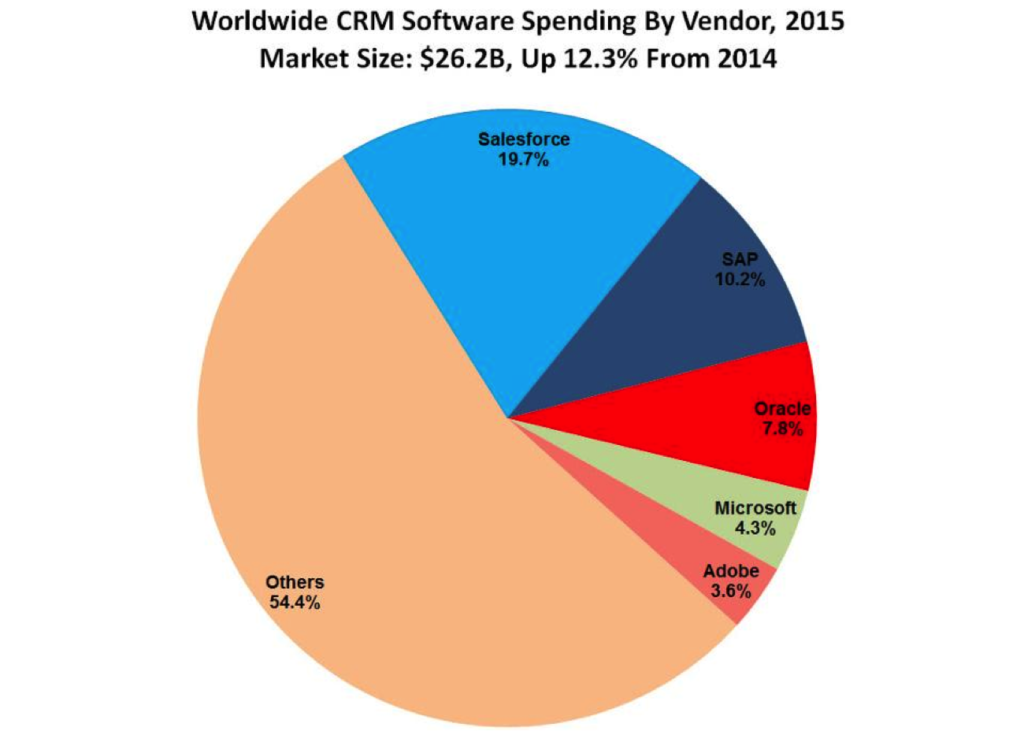

The advantages of Saas propelled Salesforce to the front of the line, and the company enjoyed nearly 20% share of the CRM market in 2015, higher than the combined market shares of SAP and Oracle.

Now, Oracle has also decided to push hard into the SaaS market. The company bought Netsuite for 9.3 billion dollars, mainly because they were the number one player in the Cloud ERP market, another major area in the enterprise management software segment.

CRM software spending by vendor

“The cloud software market reached $48.8 billion in revenue in 2014, representing a 24.4% YoY growth rate. IDC expects cloud software will grow to surpass $112.8 billion by 2019 at a compound annual growth rate (CAGR) of 18.3%. SaaS delivery will significantly outpace traditional software product delivery, growing nearly five times faster than the traditional software market and becoming a significant growth driver to all functional software markets. By 2019, the cloud software model will account for $1 of every $4.59 spent on software.” – IDC

Though the SaaS market seems to be on a tearaway growth path, it must also be noted that it is eating into the traditional software market. Buyers are only shifting from one model of buying software to another, but the advantages of cloud, on-demand, user-based pricing model does help expand the market.

Ten years ago, if someone told a small business owner that someday he or she will be able to put artificial intelligence to handle their business analysis needs, they would have never believed it. But cloud has made it possible. Case in point: IBM recently announced that it will make quantum computing commercially available on its cloud platform.

Cloud has completely transformed the software market, and companies like Microsoft, Salesforce and Oracle are leading the pack with their SaaS product line-ups, and they are well positioned to maintain their dominant roles for years to come.